By Nathan Rigby, VP Sales and Marketing at One Click Retail

Can Amazon really compete in Tools & Home Improvement? Major retail chains like Home Depot and Lowe's had a very good 2017 and show no signs of giving up their market leadership, and the sector is one of the few that is still sometimes called "Amazon-proof". But it's been proven time and time again that nothing is truly Amazon-proof – it's just a matter of time.

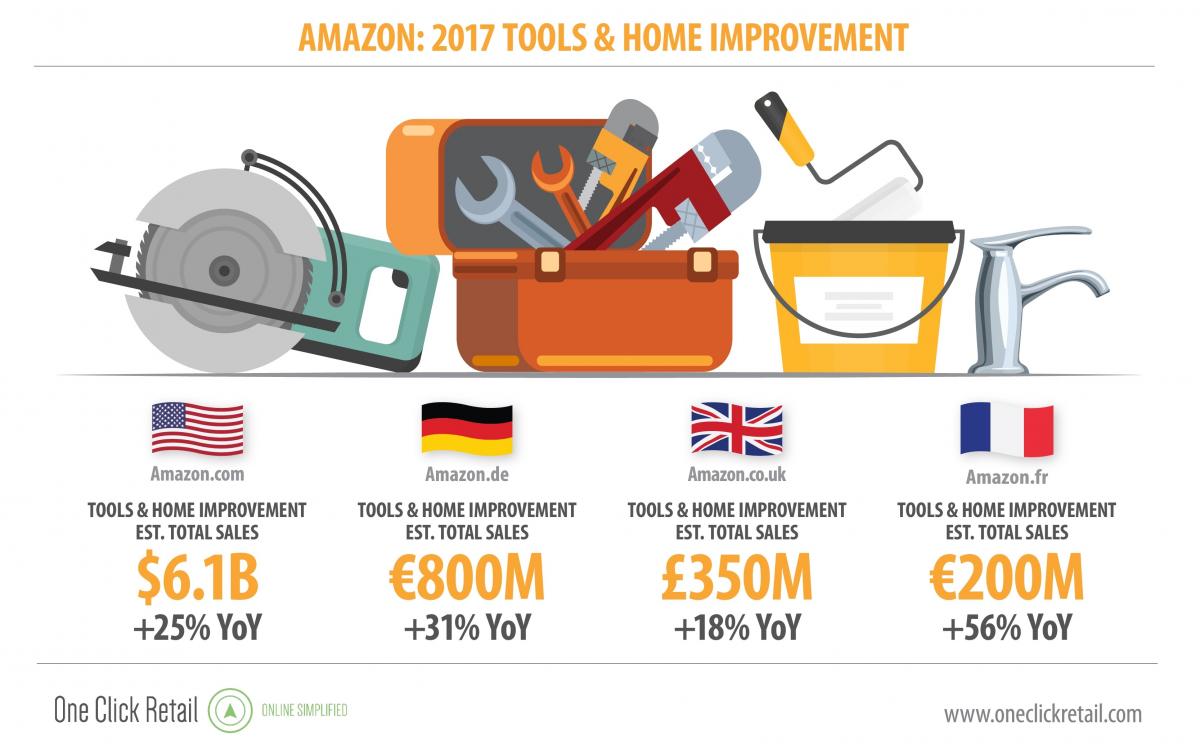

With over $6 billion in annual sales estimated for 2017, Tools and Home Improvement are major product groups for Amazon, but that's a far cry from Home Depot's sales of nearly $24 billion in Q4 2017. The leading brick-and-mortar chain saw sales driven by big ticket professional tools and growth in their online sales, but total year-over-year growth was recorded at only 7.5%. In comparison, Amazon is experiencing 25% YoY growth, four times faster than Home Depot.

The fact that Home Depot's online marketplace now accounts for 6.7% of their sales is proof enough that Tools and Home Improvement are moving online as surely – and inevitably – as any other product group. Since Amazon is the largest online retailer in America by far, brands in this sector have no choice but to invest in Amazon if they want to remain competitive.

To be more specific: while brick-and-mortar chains are seeing growth in their "Pro customer" sales in response to growing profits in the construction, trades and the automotive industries, Amazon is rapidly capturing the bulk of the DIY and prosumer market.

What's Big: Amazon Home Automation

In 2017, brands across many different product groups found success but adding Alexa-integration to their flagship products. Alexa, Amazon's voice-activated personal assistant originally developed for the Echo smart speaker, has allowed everyday household items such as lamps, sprinkler systems and thermostats to compete in the emerging home automation space and climb to the top of their respective categories.

Today, home automation is a major purchase motivator for consumers and an opportunity for brands in the Home Improvement space. The top 3 bestselling home improvement items of 2017 all featured Alexa compatibility: the TP-Link Smart Plug which can control your outlets from a distance, the Ring Video Doorbell (Ring was acquired by Amazon in February 2018) and the Nest Learning Thermostat, which introduced Alexa-compatibility to the 3rd generation of its successful smart-thermostat line.

What's Growing: Security & Safety

Brands can learn a lot by keeping an eye on how Amazon invests their money. They have one of the world's largest collections of consumer behavioral data, so their acquisition of the home security startup Ring is in response to the growing consumer demand for Security and Safety products. Ring, best known for their Video Doorbell, was bought by Amazon for $1 billion in February.

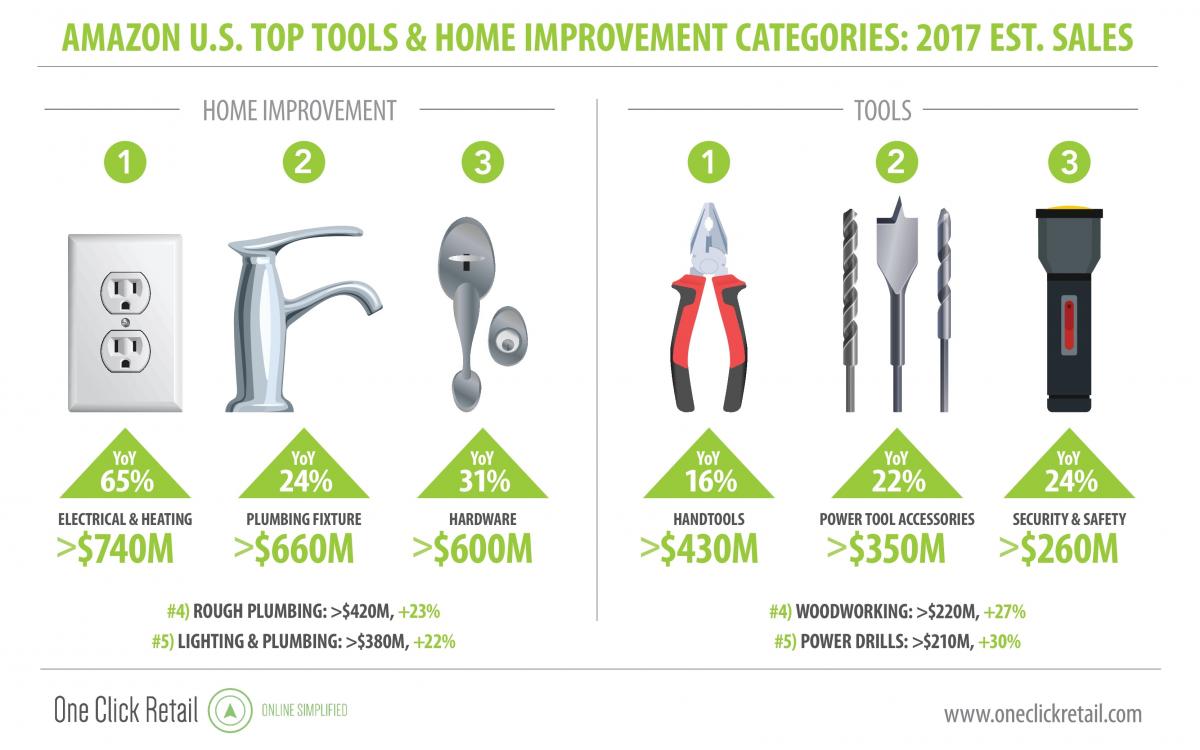

What may not be immediately clear is that Security & Safety is a major growth driver. While the category ranks #3 in the Tools product group with growth at 24% and estimated value at $260M, security-related products are also driving sales in several other categories. The leading Tools subcategory is Personal Protective Equipment; Fire Safety and Security & Intrusion Monitoring are both responsible for a number of the top 20 bestselling Home Improvement items of 2017; and the success the Ring Video Doorbell and similar items is helping to drive the 55% growth in the Electrical & Heating category.

The total growth in this space is obscured because Amazon organizes these items into several different categories, but the flipside is that brands have a big opportunity to get a lot of visibility as consumer place more and more value on safety and security.

What's Stable: Black+Decker

Though Power Drills was only the 5th largest Tools category, it dominates the top items of 2017 with the #1 and #2 bestsellers and seven of the top 20 items. Of these seven, four were from the DeWalt brand and another two were from Black+Decker, which owns DeWalt.

14 of Amazon's 20 bestselling Tools of 2017 were sold by Black+Decker, with DeWalt-brand items ranking as #1 in several categories including Power Tool Accessories, Woodworking, Power Drills and Power Saws. Though other brands such as Stanley and Howard Leight have category bestsellers, no other brands so fully dominate their categories the way Black+Decker does.

Black+Decker's success with its brands is not simply due to pre-established name recognition, it's also a result of the manufacturer recognizing the importance of Amazon as a sales channel for tools well ahead of the competition. By capturing online tool sales early, Black+Decker is able to own the search terms and the results pages, which makes it harder for late-coming brands to gain visibility.

What's Next: DIY

Black+Decker may dominate the list of bestselling tools, but they are nowhere to be found in the #1 Tool category of 2017: Handtools. With estimated sales of $430M (more than 20% higher than the runner-up category) and 16% YoY growth, Handtools reveals is a major market on Amazon that is not dominated by any one brand. The bestselling Handtool of 2017 – a 65-Piece Homeowner's Tool Kit from Stanley – is not even among the top 20 bestsellers, even though it leads the #1 category. What this tells us is that sales in this category are spread out across many products and many brands, suggesting the Handtools space is ripe for competition.

The keyword in the title of Stanley's #1 product is "Homeowner's". A new generation of homeowners is investing in Home Improvement and opting to do it themselves rather than hiring an expensive contractor. The DIY handyperson trend is made possible by the proliferation of online tutorials and YouTube guides – and with consumers already getting all their home renovation knowledge online, it's not much of a leap for them to open a new tab, type "Amazon" and buy the tools, parts and fixtures they're going to need.

Beyond Handtools, DIY projects have also driven Plumbing Fixtures and Rough Plumbing to rank as the #2 and #4 largest Home Improvement categories, while four of the top 10 items of 2017 were Appliance Parts (supplied by four different brands). Amazon's "infinite shelf" is a definite driving force here, allowing consumers to choose the perfect fixtures and find specific replacement parts for their needs.

Even though Amazon's share of the Tools & Home Improvement market remains relatively low, more and more Amazon shoppers are buying homes, taking on Home Improvement as a hobby, and building their workshops from the ground up. As their skills increase and they take on more projects around the house, their loyalty to Amazon will cause more sales to go online. The old-fashioned American hardware store is going to feel the Amazon Effect – and the brands that invest in this sales channel now will reap the reward.

One Click Retail is the industry’s most accurate source of sales data for the world’s top eCommerce marketplaces. Using a combination of website indexing, machine learning and proprietary software, OCR estimates weekly online sales figures with market leading accuracy in order to deliver the best insights, analytics and strategies to their brand manufacturer clients. To catch a glimpse of how OCR gives brands critical edge on online platforms with our unique data and expertise, subscribe to our weekly eCommerce insights blog, and follow us on Twitter and LinkedIn.

If you are a brand manufacturer who would like to learn more about how you stack up to the competition—or would like to see your market share and category growth insights—email us at info@oneclickretail.com for a free capabilities demo or fill out the form on the right.